The $100B+ Responsibility of Emerging Managers

Emerging Managers are in a position to create immense economic impact - but this massive opportunity can only be realized if we are accountable and aware of the gravity of our responsibility.

In this piece we will illustrate case studies demonstrating the scope of venture’s economic impact and share insights regarding the profound responsibility emerging managers have to continue a strong legacy of innovation.

Key takeaways:

Emerging managers are a growing part of the venture ecosystem and we cannot afford to fail

Continued innovation and global economic growth is dependent on the strength of the venture ecosystem, including the success and performance of emerging managers

Emerging managers have a responsibility to utilize capital in a way that provides the greatest economic impact

With the average lifetime of the top funds being 25+ years, there are inevitable leadership shifts in the venture landscape which require genuine mentorship to ensure the success of future generations

A Brief History of Venture

Venture capital has significantly influenced economic growth in both the United States and globally by providing essential funding for many of the most innovative and economically impactful companies. By facilitating investment in sectors such as biotech, pharma, enterprise and consumer tech, venture capital has become a vital engine for innovation, contributing to substantial increases in Gross Domestic Product (GDP) while also creating entirely new markets, ecosystems, and services [1].

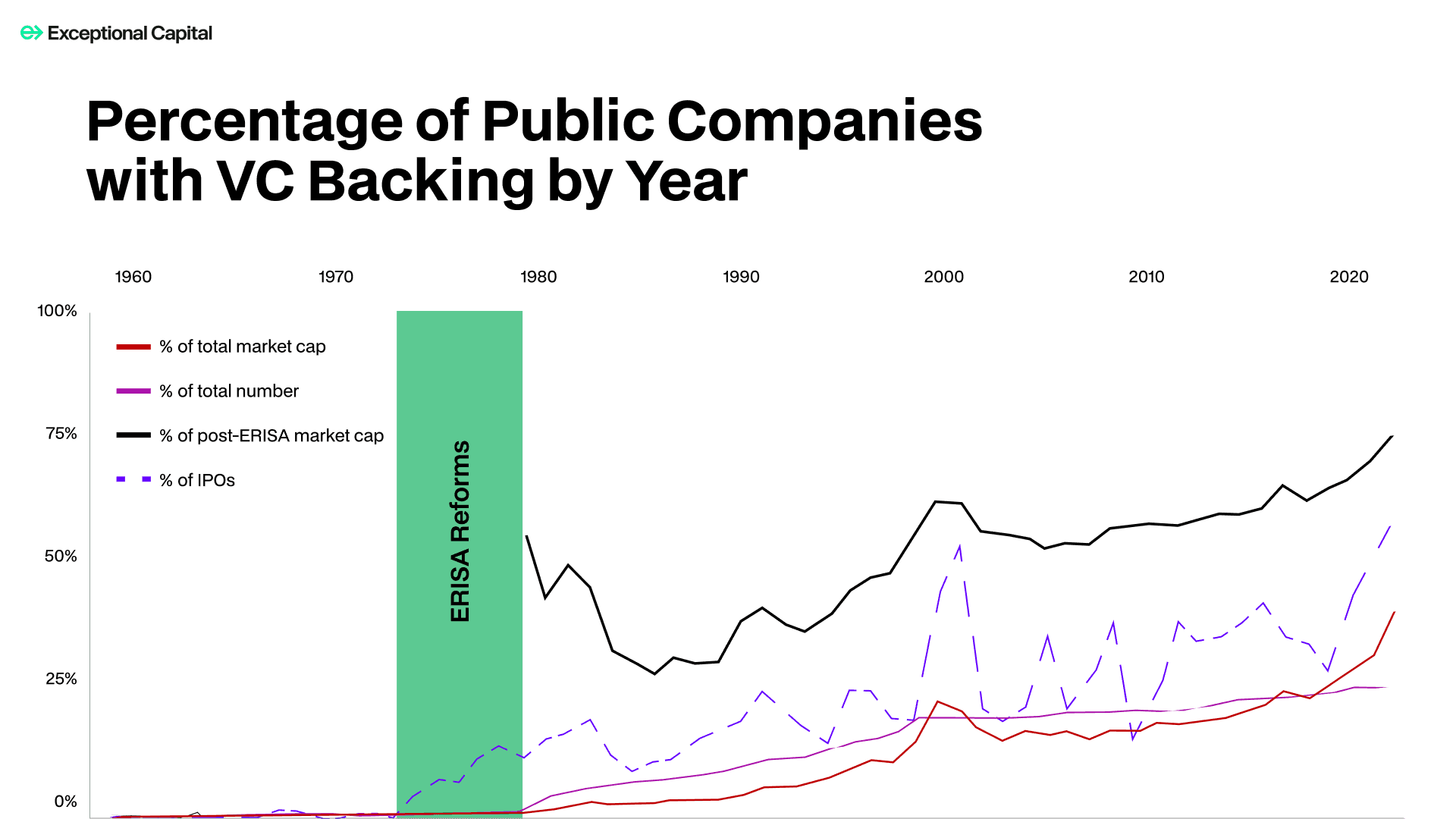

Venture has evolved from its earliest days of wealthy patrons funding risky ventures, to a more structured and systematic approach that emerged in the mid-20th century. The establishment of entities like the American Research and Development Corporation and Employee Retirement Income Security Act (ERISA) reforms ushered in a more formal venture capital ecosystem which has since undergone numerous cycles of growth and contraction [2,3,4].

As a significant driver of economic growth in the United States, venture continues to profoundly influence GDP. Venture-backed companies account for 41% of total US market capitalization and 62% of US public companies’ R&D spending; among public companies founded within the last fifty years, venture-backed companies account for half in number, three quarters by value, and more than 92% of R&D spending and patent value [5]. VC-backed companies supported over 12 million jobs globally in 2023, creating ripple effects across many diverse economies [6].

Against this historical backdrop of venture, we have for the past 5+ years seen a surge of emerging managers. Every week, every month, we see GPs leave notable multi-stage firms to start their own firm or join a promising emerging firm. The succession plans of certain firms are in effect and new decision makers will be at the helm. The structure and architecture of the venture industry has shifted in a way that creates space for new managers. Given this new reality, how will the investment responsibility shift?

Emerging Frontier

Current changes within the venture landscape are complemented by a strategic pivot toward nascent technologies, with artificial intelligence and increasingly sophisticated machine learning standing out as a primary focus. In 2024, AI startups attracted a record 46% of US venture capital funding, underscoring the sector's growing prominence and the shifting priorities of investors [7]. Investment in new technology is also an essentiality in helping the US stay competitive regarding development and access to the most valuable software and hardware - the most recent example of this being the discourse surrounding DeepSeek and Nvidia. Funding the most innovative ideas and founders presents the opportunity for the US to compete and stay ahead of technological development in the global arena.

Additionally, emerging managers need to understand the persona of Limited Partners (LPs) who are dependent on us to generate returns. As larger firms continue to go through succession phases, it is possible that an increasing amount of capital allocated to emerging managers will come from non-profit organizations and endowments, including universities and hospital systems - which have mission-critical initiatives such as developing world-class academic programs, funding clinical trials and medical advancements, and providing need-based and merit-based financial aid at universities.

The reality is that emerging managers have to be successful and utilize capital in a way that provides the greatest economic impact at home and abroad. The risk in not doing so extends beyond the question of whether emerging managers stay in business and maximize returns to LPs. Lacking accountability to this responsibility has repercussions on a massive global economic scale if we miss opportunities to appropriately fund and support innovation. Furthermore, the venture ecosystem can and should be positively impacted by tenured investors. It is imperative that emerging managers succeed and their success can be supported by consistent, meaningful mentorship by seasoned VCs.

Economic Impact of Venture Funding: Case Studies

In this section of case studies, we will outline examples of the most significant domestic and global economic impact outcomes of venture funding, as a way to highlight the continued necessity for success in venture.

Google (Kleiner Perkins, Sequoia)

Advertising alone generates over $426 billion annually in economic activity for US businesses and employs 135,000 workers directly, with an estimated multiplier effect supporting an additional 400,000 jobs [8].

Before its rise to dominance, Google was rejected by 70+ firms before Kleiner Perkins invested [9].

Revolutionize Access to Information: Allowing billions of people worldwide to access and disseminate complex information.

Educational and World Influence: YouTube - from entertainment to transforming how people learn; Google Scholar - enables sharing of academic articles, studies, books, and more.

Uber (Benchmark, First Round)

Adds $17 billion annually to the US economy through driver earnings and service expansions. Research shows that Uber’s presence reduces urban traffic congestion costs by optimizing ride-sharing logistics [10, 11].

Uber's global expansion has significantly influenced the international ride-sharing market, inspiring similar platforms worldwide. In 2018, Grab acquired Uber's operations in Asia, consolidating its presence across eight major Southeast Asian nations. This global proliferation of ride-sharing platforms underscores Uber's substantial impact on the worldwide transportation industry [12].

Meta (Accel, Greylock)

In 2005, Accel Partners invested $12.7 million in Facebook's Series A funding round, facilitating its rapid expansion. Greylock Partners also participated in subsequent funding rounds, contributing to Facebook's growth into a global technology leader.[13].

Strategic acquisitions, including Instagram (2012, $1 billion) [14] and WhatsApp (2014, $19 billion) both strengthened Meta's position in global messaging and social networking services [15]. As of April 2024, Facebook had approximately 3.07 billion monthly active users, while Instagram and WhatsApp each had around 2 billion users. [16].

Innovations and Future Outlook: Meta is investing heavily in artificial intelligence (AI) and virtual reality (VR) technologies. Foundational models like Llama (Large Language Model Meta AI) to advance natural language processing capabilities [17] and in Reality Labs division aiming to create immersive digital experiences [18].

As of December 31, 2024, Meta employed approximately 74,067 people globally. Additionally, the company's operations have spurred job opportunities in sectors such as digital marketing, software development, and content creation. [19].

SpaceX (Founders Fund)

Reduces satellite deployment costs by 70%, saving nations and companies billions annually.

Starlink’s global expansion into underserved markets and rural economies worldwide could contribute $30 billion annually to GDP through improved internet access [20].

Revolutionizing achievability of space exploration; cost was a significant roadblock historically regarding breakthrough research with regard to aerospace; now the cost has decreased due to the implementation of reusable super heavy-lift launch vehicles like the Falcon 9 and Falcon Heavy.

NVIDIA (Sequoia)

Early funding accelerated the adoption of AI-powered GPUs, creating the AI boom that underpins autonomous driving and generative AI industries. Artificial intelligence is expected to contribute up to $15.7 trillion to the global economy by 2030 [21].

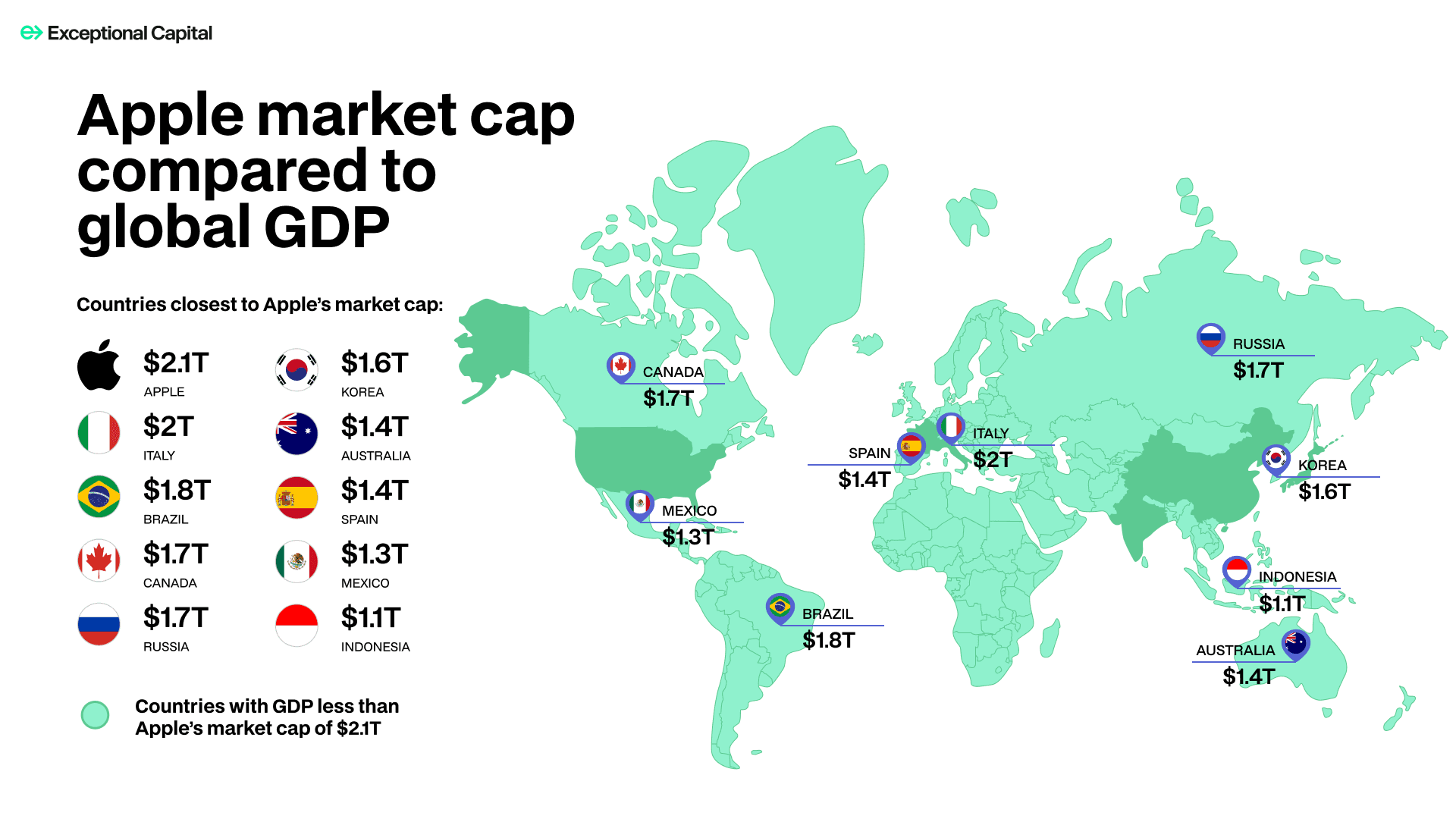

Apple (Sequoia)

Contributes approximately $275 billion annually to the US economy through hardware, software ecosystems, and exports [22].

Apple has created over 2 million direct and indirect jobs in the US, according to its economic impact report [23].

In 2023 Apple led the smartphone market with 20.1% share. In Q2 2024, Apple shipped approximately 45.2 million iPhones worldwide, accounting for 15.8% of global smartphone shipments [24].

The App Store operates in 175 countries and regions, offering apps that cater to diverse cultural and linguistic needs, thereby promoting global digital inclusion. In 2022, the App Store facilitated more than $1.1 trillion in billings and sales, more than doubling from 2019, when the total was $519 billion. As of Q2 2024, the Apple App Store offers around 1.54 million mobile apps, providing a vast array of tools and services to users globally [25, 26, 27].

As of January 2023, Apple had paid out over $320 billion to developers since the App Store's inception, underscoring its role in supporting a global developer community [28].

Moment in Time

Pharma

Moderna received $2.1 billion in venture funding before its IPO. During the pandemic, its COVID-19 vaccine added over $36B to the global economy, preventing millions of deaths and reducing healthcare costs [30].

Funding: Moderna received first round of venture funding in 2011, led by Flagship Pioneering, and raised a total of $2.1 billion before its IPO [31, 32].

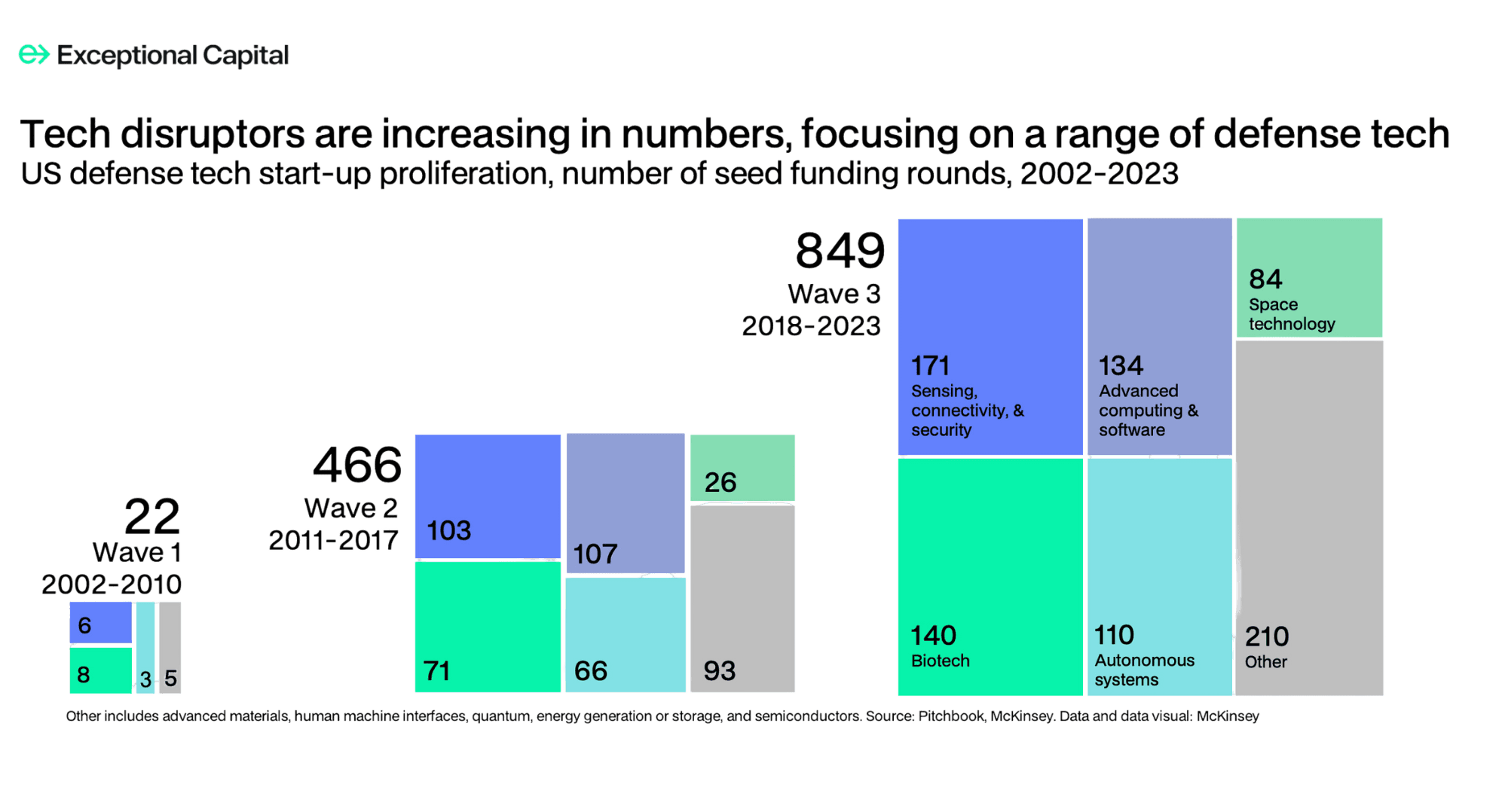

Defense

Increased venture funding defense funding grew from $1 billion in 2002 to over $20 billion in 2023. The increase in DefTech/MilTech adjacent startups have a direct correlation to the funding increase. In 13 years, the number of defense-adjacent startups rose from 22 to 849 in number [33].

Startups like Anduril (funded by a16z, among others) drive innovation in autonomous defense systems. Anduril’s AI-powered drones are expected to save $1 billion annually in operational costs for the US military.

Founded in 2003, Palantir focuses on data analytics for defense and intelligence and has raised over $1 billion in venture funding before going public September 2020 at a valuation of $21 billion. Palantir’s platforms support national security operations, including counterterrorism and military logistics, with significant global adoption by defense agencies [34].

Defense is a good example of how venture investing compels entire new industries, start-up ecosystems, and talent pools. Emerging managers need to take up this responsibility to forge ahead in new areas of investment, just as investors have done since 2010 within the defense sector.

The enduring impact of venture funding on economic growth is illustrated through successful case studies of start-ups which disrupted traditional industries and demonstrated the high-risk, high-reward dynamic inherent in venture capital investments. This historical context not only highlights the evolution of venture capital as an industry but also underscores its critical role in driving innovation and contributing to GDP growth on both a national and global scale.

To quote a 2021 study authored by Gornall and Strebulaev [35]:

The US did not spawn top public companies at a higher rate than other large, developed countries prior to 1970s ERISA reforms, but produced twice as many after it. Using those reforms as a natural experiment suggests that the US VC industry is causally responsible for the rise of one-fifth of the current largest 300 US public companies and that three-quarters of the largest US VC-backed companies would not have existed or achieved their current scale without an active VC industry.

Emerging managers are integral to the continued success and high-impact innovation of venture and need to invest in enduring businesses that:

Plan to build long-term value

Solve for the enterprise

Scale with great unit economics to be able to have strong acquisition, IPO, or other net-positive liquidity events

To provide strong returns and propel markets in the most meaningful way, we need to invest in ideas and founders that can produce liquidity and high-impact technology; the way to do that is underwriting businesses that are solving true long-term problems (not AI wrapped concepts).

Emerging Responsibility

As a continued driver of innovation and economic impact, the up and coming generations of investors have an immense responsibility on their hands. The next set of leading investors is critically important to the future of America, both economically and in terms of innovative impact across various industries.

Even as the venture landscape continues to adapt to changing market dynamics, the capacity to drive paradigm shifts across industries remains a key determinant of funds’ economic performance in addition to being advantageous to GDP. It is imperative to acknowledge this especially as we continue to witness many shifts within the investor landscape. For the purposes of this study and the research we have undertaken, emerging managers are firms raising and deploying out of funds 1-3.

Recent venture trends to note:

Earn the right to stay in business - 37% of venture funds fail to raise a second fund, highlighting the need for strong performance to maintain longevity and multiple fund cycles. PitchBook's Q1 2024 Analysis notes that approximately 37% of first-time VC managers who closed funds between 2019 and 2021 are projected to be unable to raise a second fund [36, 37].

There is a growing trend of partners departing from established venture capital firms to launch their own funds, seeking greater autonomy and the flexibility to pursue innovative investment strategies. For instance, in 2024, numerous investors from prominent firms have either left or been encouraged to depart their current roles, reflecting a broader transformation in the venture capital sector [38]. This trend opens up an enormous opportunity for emerging managers to win over the trust of young founders who may have doubts about long-term partnership throughout the lifecycle of the company with an investor at a multi-stage firm.

There are approximately 3,000 US-based venture capital funds, with an estimated 1,600 managed by unique emerging managers. Notably, 38% of these funds are under $25 million, and 53% under $50 million. Therefore, a substantial influx of smaller, agile investment entities have entered the market within the last decade [39]. Concurrently, there has been a pronounced shift in investment focus towards emerging and rapidly iterative technologies. AI startups in particular have attracted significant capital, with AI-related companies receiving close to a third of all global venture funding in 2024 [40].

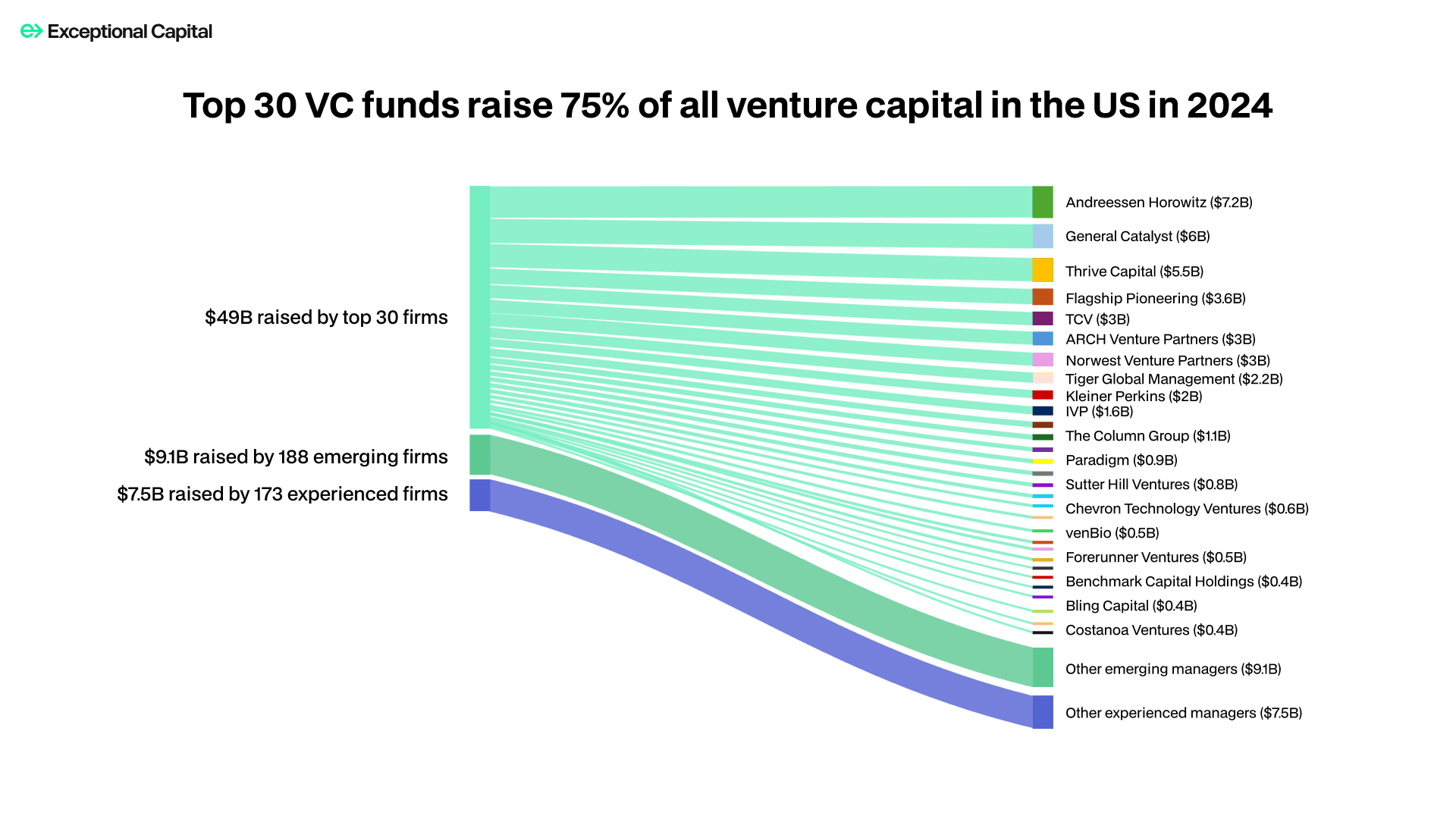

In 2024, the US venture capital landscape saw significant concentration, with just 30 firms accounting for 75% of all capital raised. Notably, nine of these firms secured $35 billion, representing half of the total capital raised. Andreessen Horowitz alone attracted over 11% of all US venture capital funding [41].

These developments make it particularly competitive for emerging managers. These trends underscore the dynamic nature of the venture ecosystem, highlighting the pivotal role of emerging managers and the evolving focus on nascent technologies in driving future economic growth and innovation. The emerging manager landscape is larger than prior decades and incredibly competitive. In addition, a huge number of firms deploying out of funds cycles 1-3 are vying to get into deals, raise capital, and build brands all within the same spaces at the same time.

Emerging Fund Data Points

The venture capital sector has experienced substantial growth in the number of emerging managers. These firms vary in size, managing assets ranging from $5–$10 million to up to $1 billion. This increase reflects a broader trend of new entrants in the venture capital space over recent years [42].

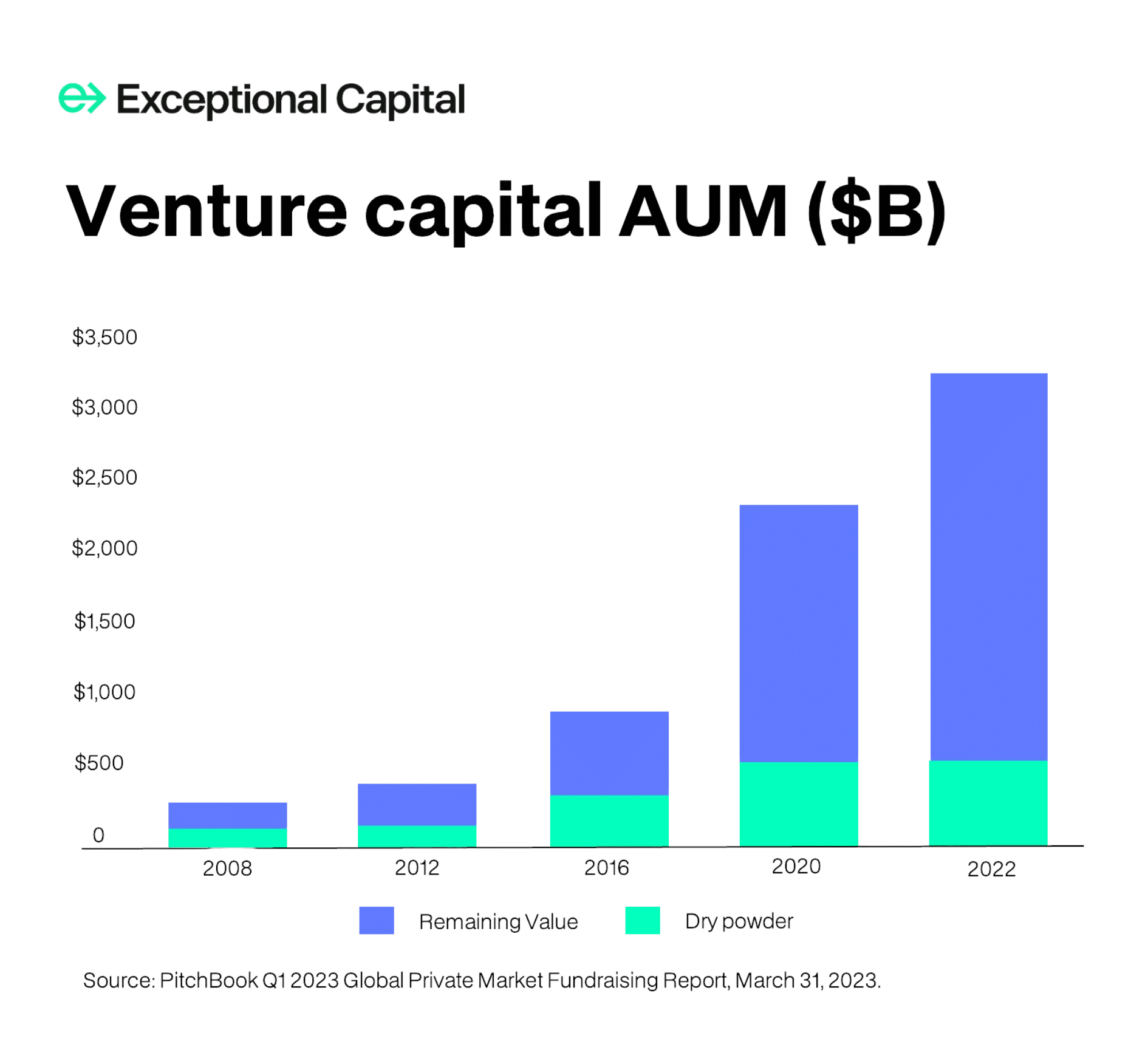

It comes as no surprise that emerging managers continue to weather challenging fundraising cycles. AngelList's State of Venture 2024 Report highlights the impact to emerging managers given the current circumstances where the amount of capital distributed to LPs does not decrease, but the ratio of distributed capital to total value can decrease. AngelList writes, "This happens when the residual value of a portfolio is increasing faster than it is being distributed to LPs….[on] paper performance of venture capital funds is still quite robust…but LPs are not seeing actual distributions from these increased values." Their report continues to describe:

The specific dynamic described above effects emerging managers attempting to fundraise from LPs in two ways: There’s no cash in an LP’s “venture bucket” to re-allocate to new fund managers, but also because the total value of the portfolios has continued to increase, allocators are likely to be comfortable with their overall exposure to venture capital at the asset-class level. With high residual valuations, LPs do not feel under-exposed to venture, and so there’s no cause for LPs to rebalance money from a different asset class to invest more into venture capital. We believe that increasing distributions to LPs—even at a discount to the current valuations of residual positions—could greatly benefit the asset class. These distributions would enable venture fund LPs to reinvest in a more diverse set of managers and new startups.

The need to be strategic, thoughtful, and creative in capturing return and liquidity opportunities will likely be one of the strongest differentiators for who can be successful in continuing to raise new funds.

Our basic responsibilities as emerging managers are as follows:

Invest in innovation: founders that genuinely have immense potential for maximum economic impact

Produce returns: fiduciary duty to LPs while also supporting founder success

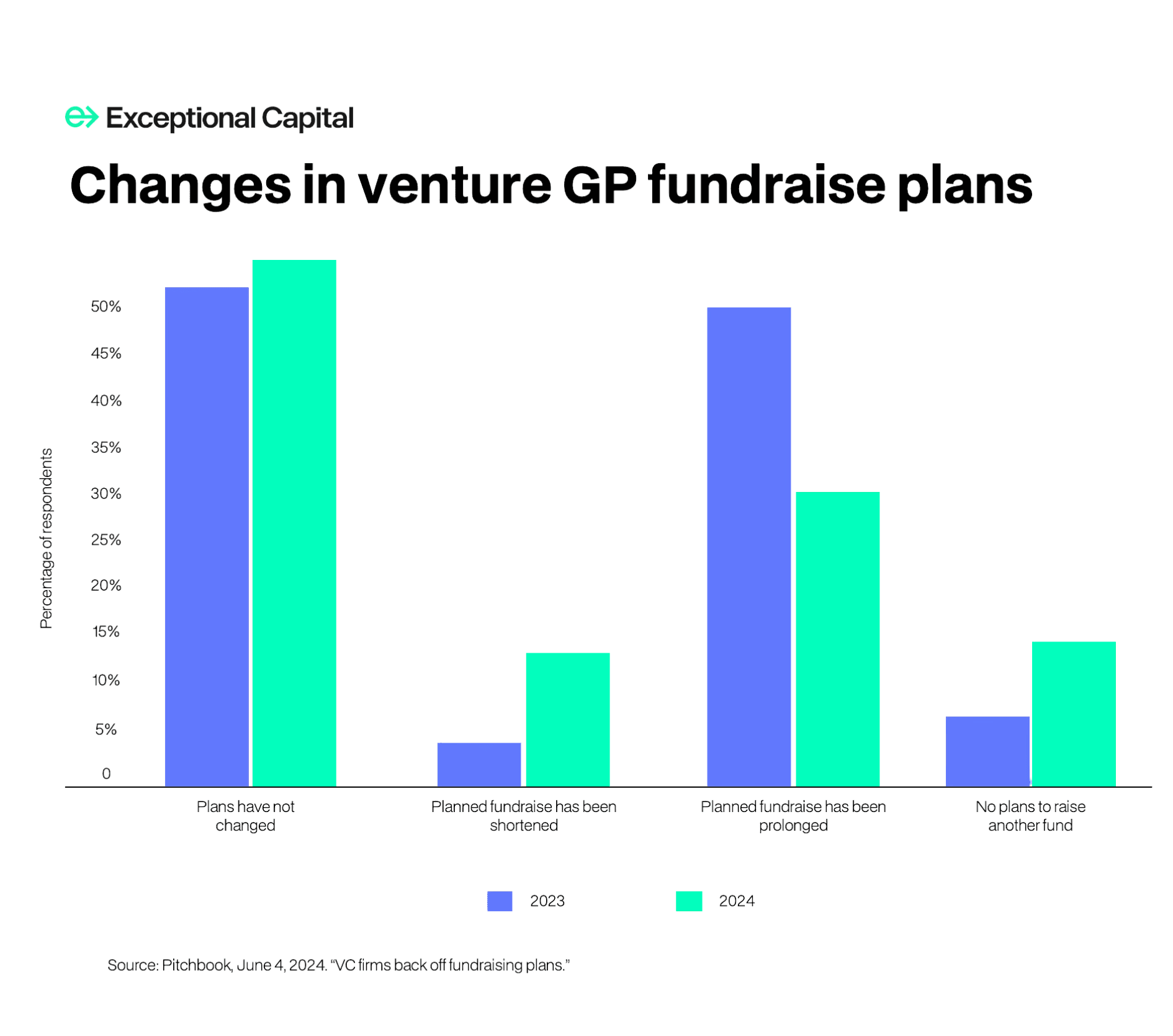

Build a generational firm: Recent data indicates that 13% of venture general partners (GPs) do not plan to raise another fund, a figure that has doubled from 6% in the first half of 2023, highlighting the need for strong performance to maintain longevity and multiple fund cycles.

There are significant headwinds currently. The above visual underscores the necessity for innovation and adaptability among emerging managers. As market and ecosystem dynamics make fundraising increasingly competitive, we have a unique opportunity to fill gaps left in the market by deploying agile strategies and capitalizing on sectors with high growth potential.

However, there is also a huge opportunity: venture as an asset class continues a positive trajectory in substantive funding, with year over year increases to AUM within the venture ecosystem more broadly. Emerging managers need to thrive, not just survive, to ensure that the trend of emerging managers as top performers and fund returners continues. According to Cambridge Associates, emerging managers account for 72% of the top returning firms between 2004 and 2016, while receiving a share of allocated capital inferior to more mature funds [43].

This trend emphasizes the critical role of emerging managers in driving innovation for the future, ensuring the continued domestic and global economic impact of the venture ecosystem. A majority of the case studies shared herein are companies for which an existing market or user was not yet established.

An Opportunity We Cannot Afford to Waste

As challenging as the emerging manager landscape may be, venture is not supposed to be simple. It has always been about taking on risk, making bets on the theoretical, abstract, and ambiguous. Emerging managers need to stay in dialogue with one another and continue to challenge ourselves to invest in the most innovative and most imaginative builders.

With every decade of evidentiary support that underpins the argument that venture is an essentiality for further innovation and positive economic and social impact, our responsibility grows. As emerging managers we need to be accountable to this - earning the right to stay in business while carrying on a legacy of funding world-changing ideas.

In order to remain accountable to effectuating this change, emerging managers need to build firms that can persist through challenging markets and volatility. We must continue to improve our tenacity and ability to withstand the unknown.

If there is an exodus of emerging managers from the venture ecosystem it will inevitably leave many LPs and founders in a difficult position.

In order to capitalize on the opportunity of investing in innovation, we must take our responsibility incredibly seriously and ensure that emerging managers can stay at the forefront of partnering with the most innovative founders of our generation and of generations to come.

Furthermore, the need for mentorship is vital and must be taken seriously by each generation of investors - existing, emerging, and future. In providing ongoing and engaged mentorship, established GPs have the ability to support future success of venture-led growth and innovation. There is a considerable level of impact that the success of emerging managers will have on future generations - the lives of ourselves, our families, and our children. This generational impact makes the future of emerging managers relevant for the entire investment community to be aligned in actively supporting.

At Exceptional, we are holding ourselves accountable to:

Being students of liquidation events and public markets

As emerging managers we have to be obsessed with strategies for what produces the best returns, operating both vigilantly and creatively. Always thinking about “what’s next” and what patterns and cycles of momentum can be observed. This includes deeply understanding both opportunities for our portfolio as a whole, but also in terms of offering the best possible support and partnership to our portfolio companies.

Remember the power of mentorship

Seasoned investors who have been in venture are invaluable. I feel incredibly grateful to have many experienced GPs who are willing to converse with and support Exceptional. However, this type of mentorship - as powerful as it has been for our journey - can be quite rare. It is not something our firm takes for granted. Don’t forget to give back by providing your own mentorship to rising investors; they will be the next wave of emerging managers and leaders in venture!

Long-term thinking

As the great Charlie Munger stated, there is immense value in "having a multidisciplinary approach." We believe in having multiple internal frameworks to evaluate companies, source future founders, and create entrepreneurship. We also intend to maintain the following two attributes as core tenants of the firm:

Obsession

Is our intellectual curiosity expanding, and are we learning quickly enough?

Are we backing founders who aim to build enduring businesses with real economic impact?

Are we exceeding expectations with our new and existing Limited Partners?

Paranoia

Are we adding quantifiable value to our founders?

At a macro level are we tracking the best communities of builders and at a micro level are we precisely identifying the best builders?

Are we earning the right to stay in business and exploring ways to productize the firm?

With research contributions and insights from Khushi Agarwal and Melissa M. Aurigemma.