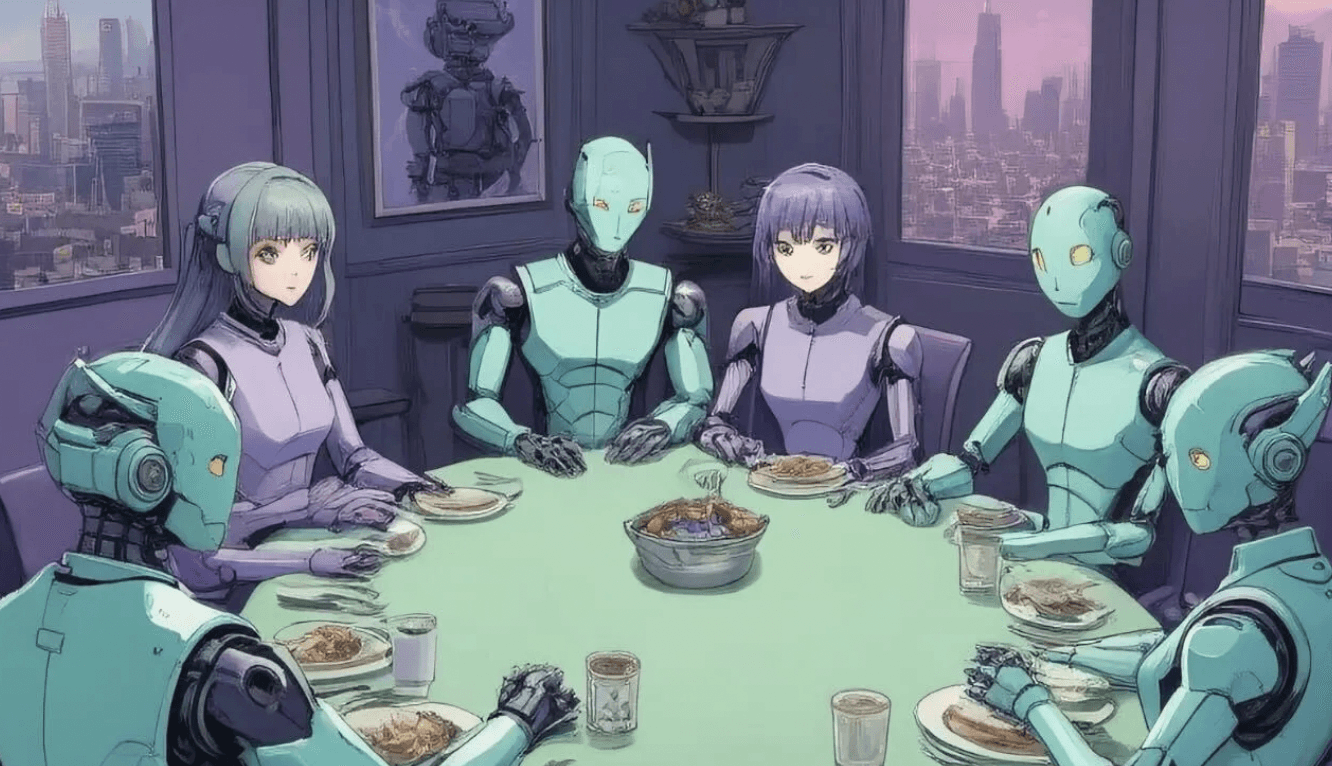

An Exceptional Dinner

Exceptional Capital co-hosted a dinner alongside Slow Ventures. We gathered product and engineering leaders as well as early founders to have a roundtable discussion covering everything from AI to venture funding dynamics. The conversation and feedback from immensely talented people from companies like Stripe, LinkedIn, Merge, ApolloGraphQL, Stytch, Pinterest, Finix and Notion, was insightful to say the least! We were also fortunate enough to have Will Quist along for the ride as well.

Learnings

AI In Production

AI in production is still a “myth” / “holy grail” goal for companies up and down the maturity stack from early to hyper growth. It’s simply not a hair on fire problem yet — this was especially true in regards to AI tools being sold to them that produce answers at scale — the issue is still around fidelity and accuracy. Engineering leads in particular don’t feel confident that the answers from current 3rd party AI systems are reliable enough to “present to the board”. However, AI is still very top of mind from a buyer perspective leading to a flurry of LOIs, POCs, design partnerships etc. The sentiment is that every software or software enabled company needs an “AI strategy” and currently engaging with these companies to hash it out is — enough — These AI tools are being poked, prodded and examined but ultimately most will not live up to the expectations (at least to this point in time).

Timeline — Second Mover Advantage

A shared hypothesis around the table based on what they’ve heard from other VCs was that “VCs are tracking many of these contracts for the next 6–12 months as we’ll be able to observe the cycle of renewals for many of these initial partnerships and there will be a ‘culling of the weak’ and churn will decide who built a lasting product”. Almost everyone at the table was a buyer of software and unanimously agreed they’re waiting to see who (among the AI startups) is able to keep their customer base and then look to those tools for confidence. In a stroke of pure (shocking) luck this echoes a prediction I had expressed to Techcrunch back in December, 2023.

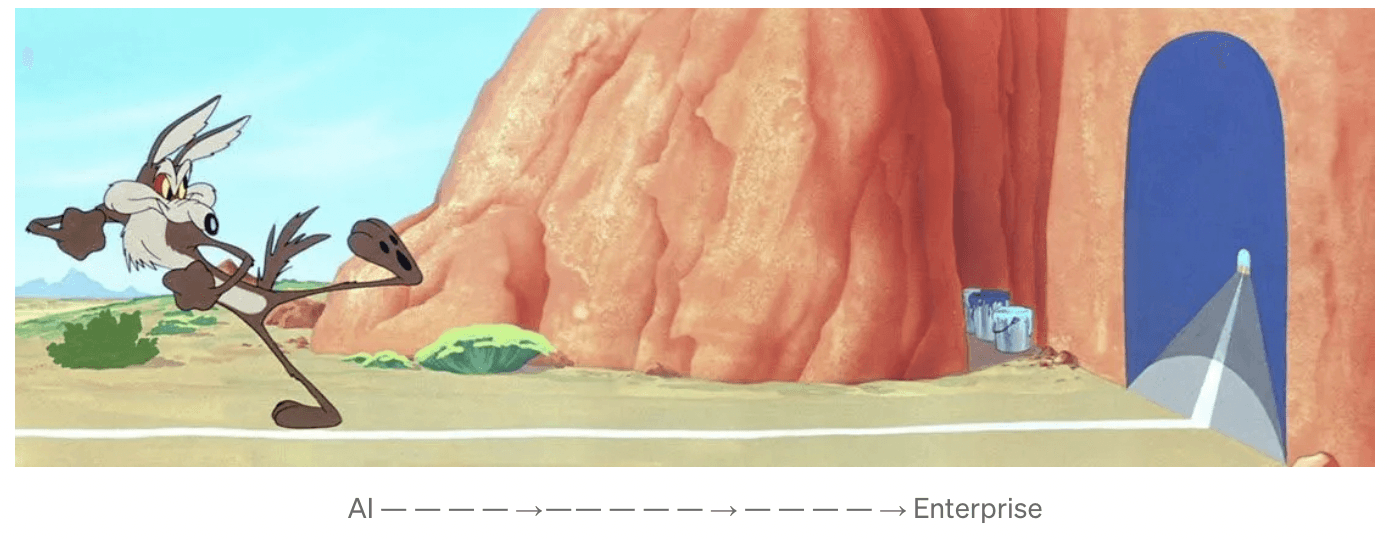

The AI native companies that demonstrate meaningful retention during this short term time frame will live on but it also begs for the right future founders to come in and question, “What went well? What went wrong? How can this be built from the ground up with these new learnings? ” Then draft off the companies slightly ahead of them who continue to concuss themselves running into wall after wall creating doors to those who follow. It was one of the more interesting takes from the night as it supports the second mover advantage playbook.

Short Term Focus on ROI

So… where do we go from here? The conversation ultimately led to, “Well where are you seeing the value?” Co-pilots were a strong source of efficiency and measurable ROI — a good chunk of the people around the table have seen the output of their developer teams ramp up and attribute a portion of this to the integration of co-pilots/agents. Admittedly, I didn’t get a chance to ask which tools in particular were being used successfully or in what capacity specifically; code generation, chatbots, CS, something else entirely) — that will be for another dinner! All of that said, we also debated whether co-pilots/agents are a current appetizer to the main course of AI once use cases and areas of deployment are defined, as well as once accuracy and fidelity become enterprise grade.